Whoa! I keep running into confusing BEP-20 token traces. Seriously, people mix up transaction hashes with token transfers all the time. Here’s what I want to do—walk you through practical checks that save time and headache. Initially I thought verifying a contract was mostly about reading a few lines of solidity, but then I realized the real work is pattern recognition across events, internal transactions, and the token’s behavior on-chain which often tells you more than the source code alone.

Hmm… Start with basics: is the token standard actually BEP-20 or a bridged ERC-20? Open the contract tab and scan the info box for totalSupply, decimals, and symbol. This sounds trivial but it’s where many trackers first go wrong. On top of that, verify the contract’s bytecode matches a published source and check if the verified source includes constructor parameters or immutable variables that could change token behavior after deployment, since those hidden knobs can flip token economics in ways that block explorers don’t always make obvious.

Really? Look at the transaction history next. Filter for Transfer events, and then cross-check the transfers with internal transactions for any moved funds that didn’t emit an event. In many scams, the owner calls functions that bypass events and siphon tokens silently. So you need to trace the path: follow approvals, follow multisig actions, examine delegate calls, and watch for self-destructs or upgradeable proxies, because proxies can swap logic while keeping the same address making the contract behave differently than when you first looked.

Whoa! Check who verified the source too. Sometimes verification is done by a known team, other times by anonymous addresses with zero reputation. Don’t assume verified equals safe. Actually, wait—let me rephrase that: verified source code gives you the opportunity to audit behavior, but it doesn’t guarantee intent, because the author may have left admin functions, blacklists, or backdoors that require reading beyond the Read Contract tab to fully understand and to see what privileged roles can do off-chain or via governance.

Here’s the thing. Use events to your advantage. Events are immutable records and they reveal typical flows like minting and burning. If you see huge mint events to an unknown address, red flag. Also correlate liquidity events: look at the pair contract for the token‑BNB pool, check who added liquidity and whether they removed it quickly, because rug pulls often show as rapid liquidity pulls that precede token dumps and usually involve router approvals or custom transfer logic that evades simple heuristics.

Why an explorer matters (and where to start)

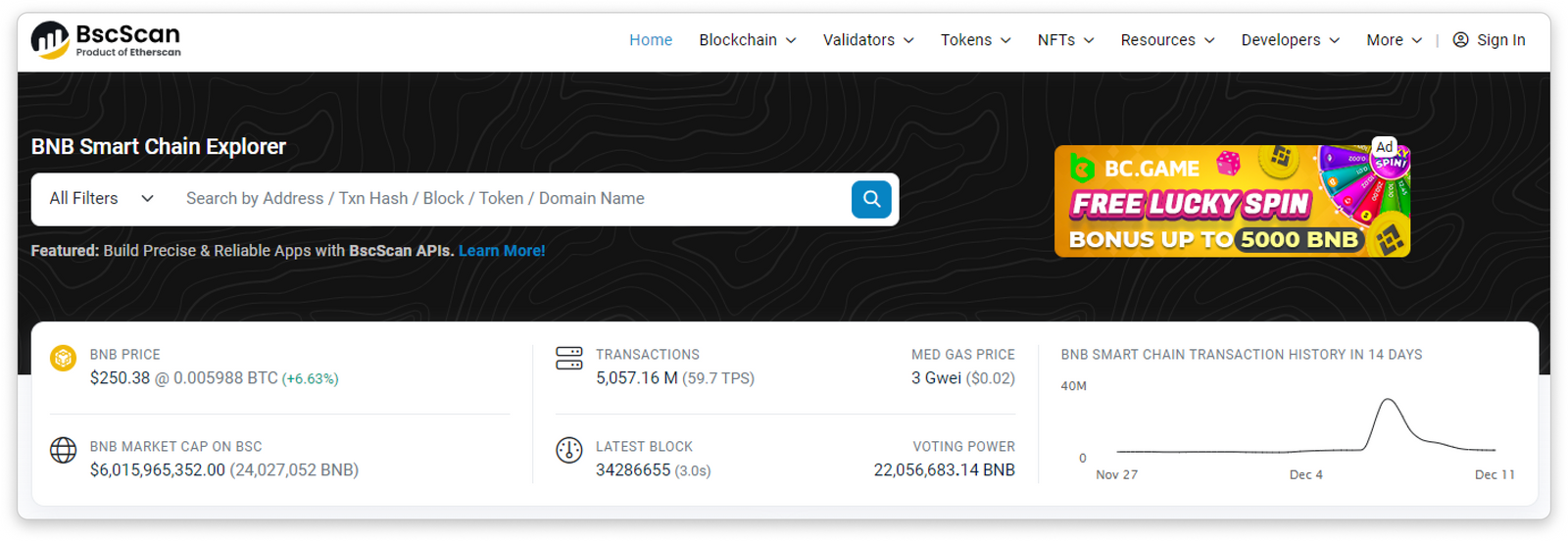

Don’t ignore contract creation traces. Creation txs tell you the deployer address and sometimes include constructor arguments in the input data. If the deployer has a history of exploit-linked deployments, you should be cautious. On the BNB Chain, a deployer might use deterministic addresses or factory contracts which spread risk across many tokens, and tracking that pattern requires cross-contract analysis and sometimes manual pattern matching across multiple verified source codes and transactions that a novice might miss. I’m biased, but I prefer starting investigations on a reliable explorer UI. A reliable explorer gives quick access to holders, transfers, contract read/write, and internal txs which are essential for good triage. bscscan surfaces the verified badge, compiler version, and optimization flags which sometimes hint at rushed or amateur deployments, and it makes exporting holders or mapping large wallets to exchanges straightforward which helps you spot concentration risk early.

Whoa! Watch for allowance traps. Approve functions that grant unlimited allowances are a common off-ramp for malicious contracts. Sometimes tokens include transfer taxes that send fees to a marketing wallet, and sometimes those wallets are controlled by anonymous accounts. Thus, you should not only inspect allowances but also decode custom transfer methods, check for on-transfer hooks, and simulate typical transactions on testnets or with small amounts before committing anything significant to reduce the chance you encounter unexpected behavior or silent drains.

Okay. One more practical tip: use small test buys. Buy a token with a tiny amount, then immediately check your token balance, allowance, and the taxed amount against the contract’s math. If the token disallows sells for certain wallets or requires vesting that’s not public, the first test buys often reveal that. Ultimately, smart contract verification and transaction tracing on BNB Chain blend intuition with structured analysis—your gut will flag somethin’ as off, and then the slow work of examining events, bytecode, deployers, liquidity movements, and allowances will either confirm the red flags or give you the confidence to proceed, though you’ll still want to keep risk management like small positions and hardware wallets in place.

FAQ

How do I spot a rug pull quickly?

Look for concentrated liquidity and rapid LP removals. Check whether the LP tokens are locked and who has the LP tokens. Also very very important: trace approvals and check for owner-only mint functions or whitelist sell restrictions—those are common signs of engineered exits.

Is verified source code enough to trust a token?

No. Verified source gives you readable code, which helps, but you must still read admin roles, pausables, and upgrade patterns. My instinct said ‘safe’ sometimes, but reading the details often changes that first impression—so read, test, and tread carefully.